Bugun Emekli Olsam Ne Kadar Maas Alirim

If I were to retire today, one burning question on my mind would be, “How much pension would I receive?” Determining the amount of retirement income is crucial for planning our financial future. The calculation depends on various factors such as years of service, average salary, and the specific retirement plan in place. In this article, we will delve into the topic of “Bugün emekli olsam ne kadar maaş alırım” (How much pension would I receive if I retire today) to shed some light on this important subject.

Retirement benefits are a result of diligent contributions made over the course of our working years. Understanding how these contributions translate into monthly or annual payments can provide us with a clearer picture of what to expect when we finally hang up our hats. By exploring the intricacies of retirement calculations and considering different scenarios, we can gain insights into potential pension amounts and make informed decisions about our financial well-being.

Whether you’re approaching retirement age or simply curious about your future prospects, this article aims to demystify the calculation process and provide valuable information regarding pension amounts. By breaking down key factors that influence retirement benefits and offering practical tips for optimizing your income during post-work life, we hope to assist you in navigating through the complexities of determining your potential pension amount. So let’s dive into the world of pensions and discover what awaits us when we exchange our work suits for leisurely pursuits!

Factors That Determine Retirement Benefits

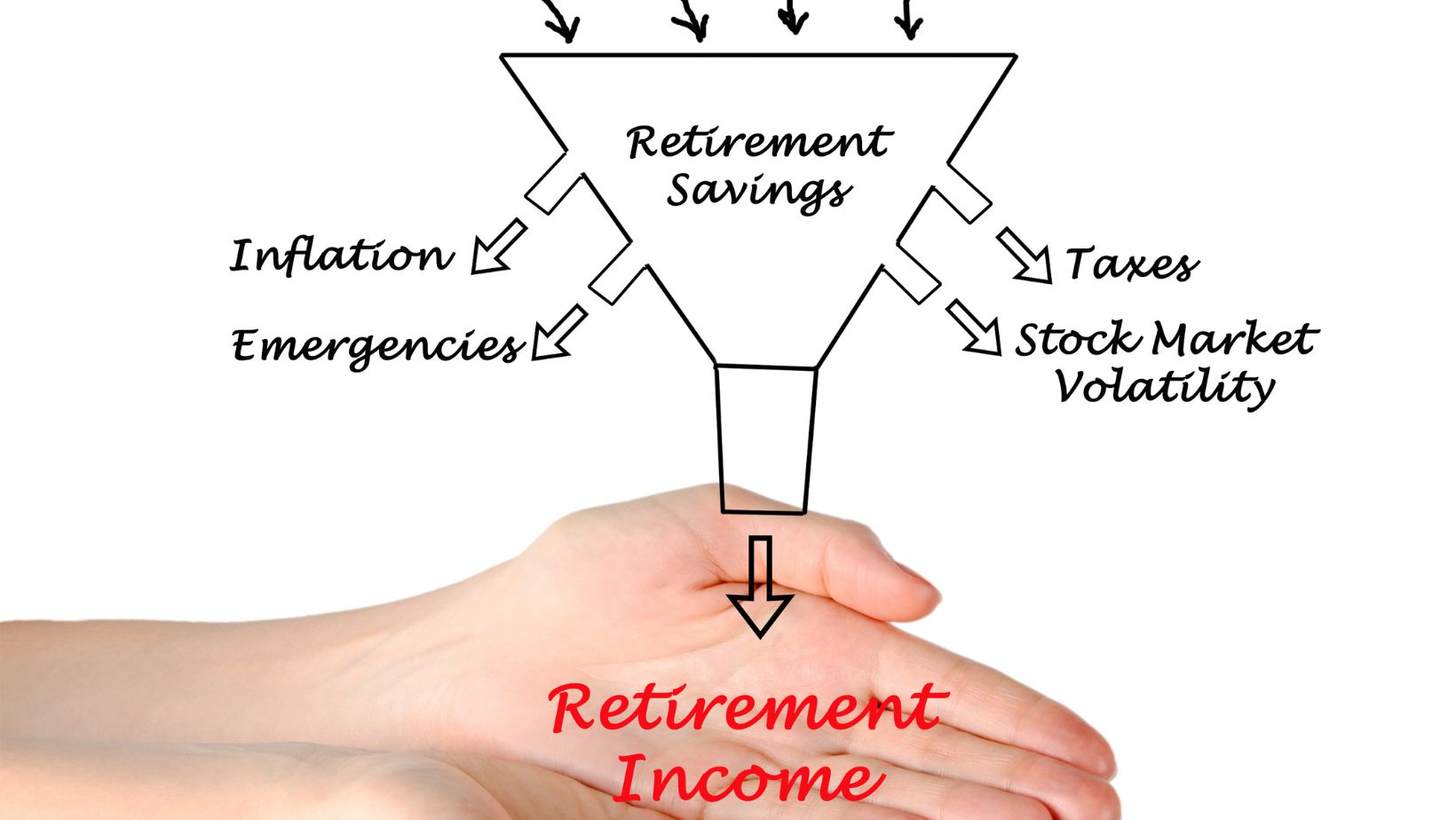

Retirement benefits are influenced by various factors that play a crucial role in determining the amount of income one will receive during their retirement years. Understanding these factors can provide valuable insights into how retirement benefits are calculated and what individuals can expect when they decide to retire.

- Length of Service: The number of years an individual has worked is an essential factor in calculating retirement benefits. Generally, the longer you have been employed, the higher your benefit amount is likely to be. This is because extended periods of service often result in increased contributions towards retirement funds, which ultimately translate into higher monthly payments after retirement.

- Average Salary: Another significant factor is your average salary over a specific period preceding retirement. In most cases, the formula used to calculate retirement benefits takes into account your average salary during the highest earning years of your career. A higher average salary typically leads to larger pension payments upon retiring.

- Contribution Rate: The percentage of your income contributed towards a retirement fund also affects the amount you’ll receive as a retiree. Higher contribution rates mean more money being set aside for future use, resulting in greater financial security during retirement.

- Government Regulations: The government sets guidelines and regulations that determine how much individuals are entitled to receive as part of their retirement benefits program. These regulations may vary from country to country or even within different states or provinces, so it’s essential to stay informed about current laws and policies governing retiree benefits in your area.

- Investment Returns: Some retirement plans invest contributions in various financial instruments such as stocks, bonds, or mutual funds with the aim of generating returns over time. The performance of these investments can impact the size of your final benefit payout at retirement.

Understanding these key factors can help individuals make informed decisions regarding their contributions and plan effectively for their post-retirement finances. By considering aspects such as length of service, average salary, contribution rate, government regulations, and investment returns, individuals can better estimate their retirement benefits and ensure a more secure financial future.